INTRO

This page is designed for readers who would like to “spice up” their portfolios with Tech holdings which are “more explosive” investment instruments and improve the overall returns, or kids with very long term investment horizons who can generally absorb larger volatility and can fully be invested in Tech.

The Tech ETF portfolio is designed for passive investors who do not want to spend their time analysing companies, constructing portfolios, monitoring price moves, do excessive trading but they want to participate in explosive Tech bull markets which can generate returns far above market (SPX) returns, or balanced 60:40 portfolio returns.

It’s important to note, this Tech ETF portfolio is “high beta” portfolio with amplified price movements both to the upside and the downside, hence it’s not appropriate for everyone. It’s also important to note, this is not an investment advice or investment recommendation. Investors should do their own analysis, and invest money according to their investment objectives and risk tolerances.

CURRENT MODEL PORTFOLIO UPDATE

UPDATE: APRIL 28, 2024

Model portfolio keeps the original assets and weights. Prices of all assets are above their respective 200 day moving average, hence they are in Bullish trend.

Portfolio return: YTD = 16.44%

Market return (SPY): YTD = 7,87%

Note: Simulated returns are using GBTC instead of HODL for crypto, as our backtesting tool is not able to model European ETFs.

1) WHY INVEST IN DISRUPTIVE TECH

HIGH IMPACT ON SOCIETY:

Disrupting technologies such as Artificial Intelligence, Cloud computing, Robotics, Gene editing, Cybersecurity or Blockchain are already impacting all aspects of our lives in meaningful ways. With new discoveries in biotechnology our life expectancy is increasing every day, AI is impacting everything form autonomous vehicles, to cybersecurity, research & development, defence systems, to creating videos, movies or new music, to simply helping you write your homework or write your work documents. Blockchains and crypto technologies are rapidly building parallel financial networks which are not in control of major financial institutions nor any government.

HIGH INVESTMENT RETURNS

Companies which are able to build superior products and those who deeply impact the way people live, work or get entertained usually grow their revenues rapidly as they are conquer markets across the Globe. Durable high revenue growth is one factor which is highly correlated with investment returns, and that’s the key reason why investors should consider putting at least part of their portfolio in disruptive Technologies which have reasonable possibility to dominate the world in their respective segments in decades to come.

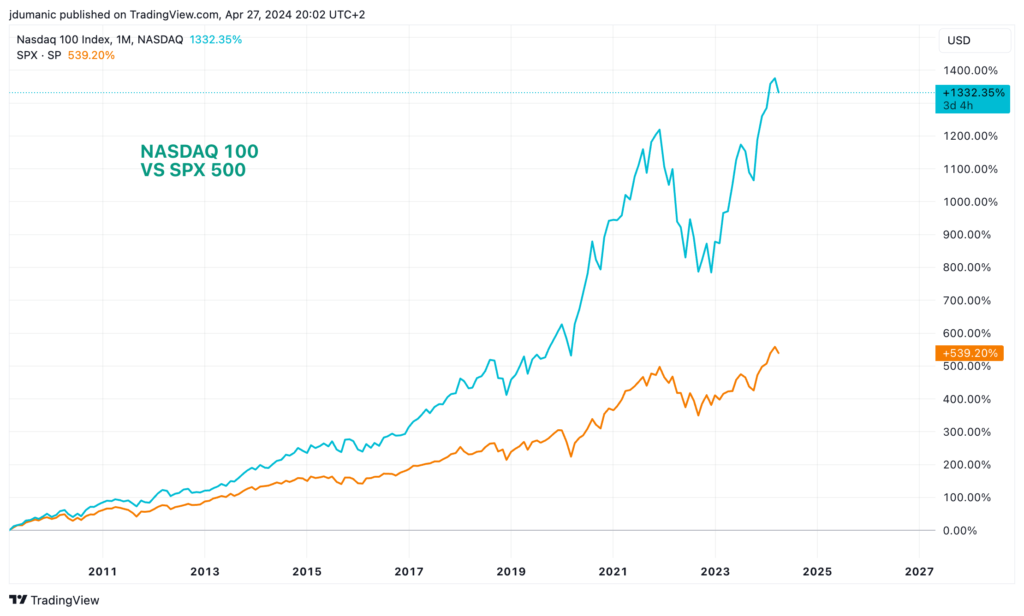

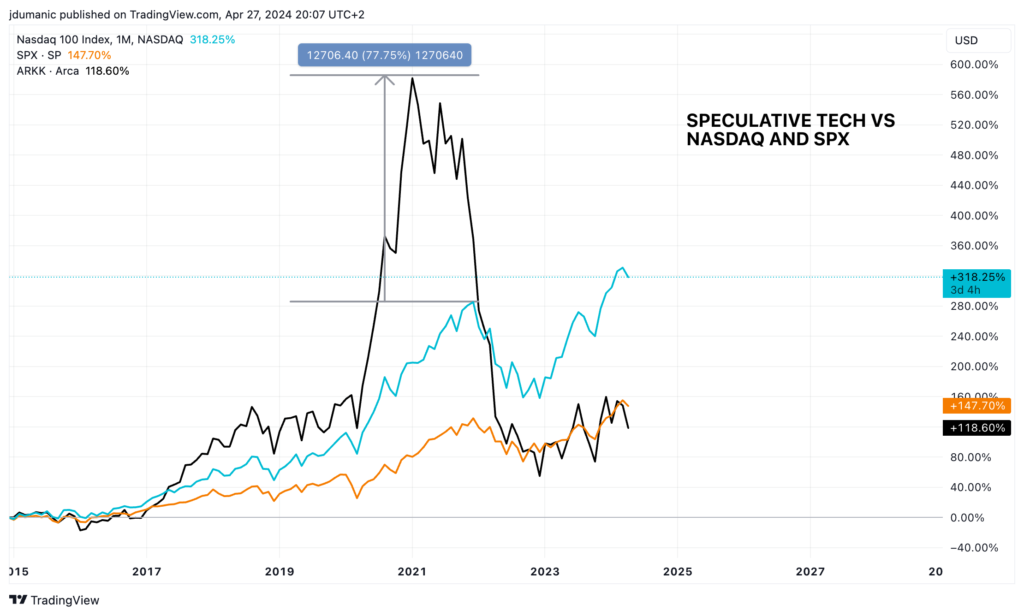

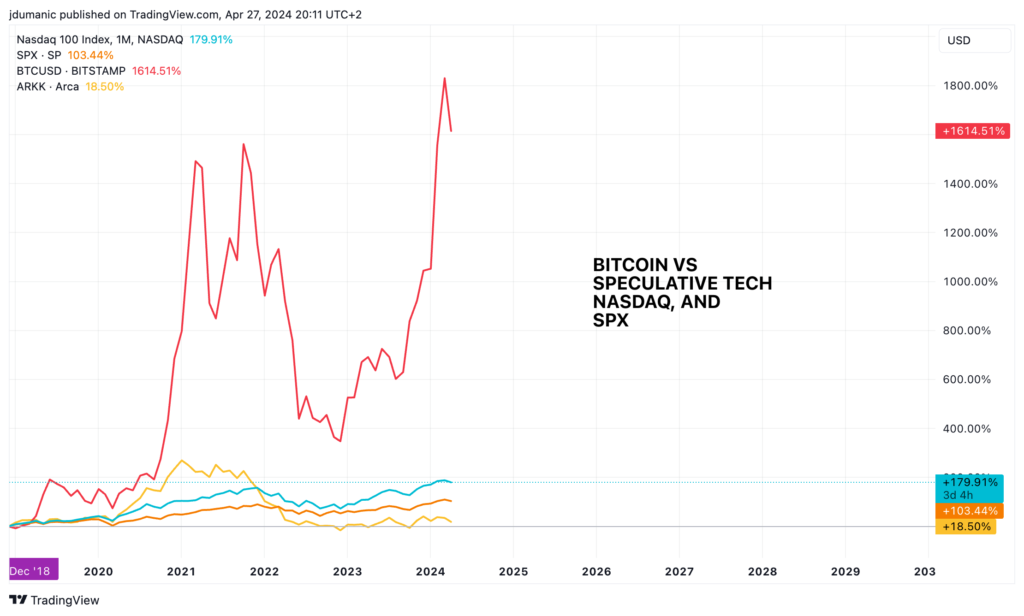

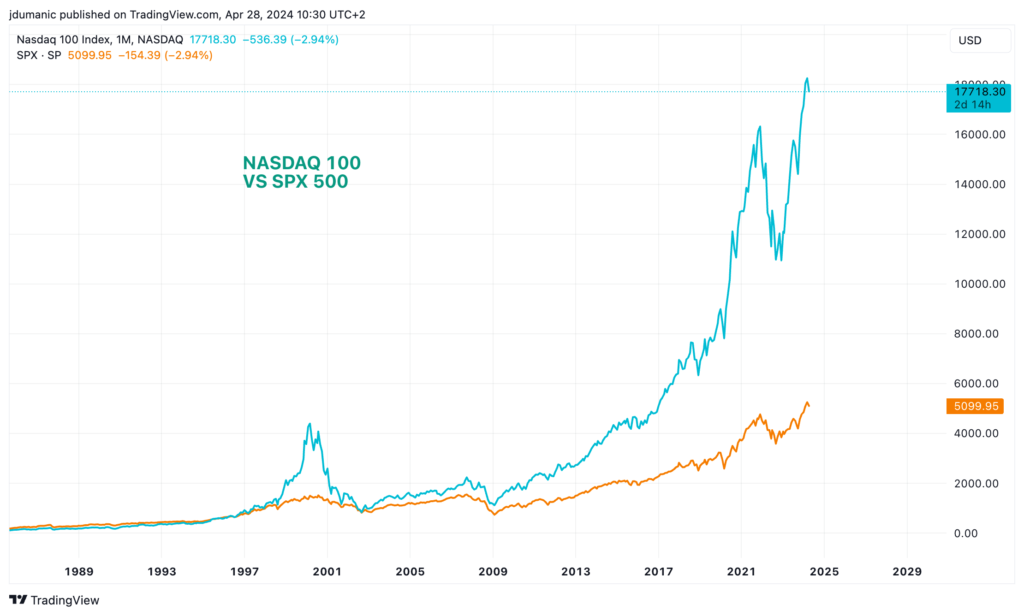

The above charts display the return differences between different instruments during the BULL market cycles. As you can see “Blue Chip Tech” (Nasdaq) beats the Market (SPX) a bit more than 2:1 since the last bull market started in 2009. Until 2022 (before the start of the lates Bearish episode), Speculative (high growth Tech) has outrun “Blue Chip Tech) also 2:1, or 4:1 if we compare the results with the Market (SPX) returns. Bitcoin has dwarfed everything else during similar bull phase runs.

The point of those graphs above is NOT to prove the Tech investments are superior investments in all time frames. Of course the opposite is true during Bear market episodes. For example during the latest correction in 2022, SPX had maximum loss from the previous peek of 27%, Nasdaq was down 38% while Speculative Tech and Bitcoin were down massive 89% and 78% respectivelly.

The point of those graphs above is to show that during long lasting bull markets, Tech investments represent great opportunity for investors to capture superior returns, and tech should be considered as core holdings for all who seek above average returns.

Even when we compare returns of Tech vs Market over very long time, including 2 devastating bear markets in 2000 where Tech lost more than 90% of it’s value and 2009 where Tech lost more than >50% of its value, Tech still outperformed SPX by more than 3:1.

2) CONSTRUCTING LOW MAINTENANCE TECH PORTFOLIO

Nowadays you can easily construct passive Tech portfolio with minimum effort to maintain it, and you can participate in Tech returns which will be driven by AI, robotics, cloud computing, autonomous vehicle, biotechnology advancement in gene editing, crypto platforms and many more exciting technologies.

1. FIRST, DECIDE WHAT’S APPROPRIATE TECH EXPOSURE LEVEL FOR YOU. We are not financial advisers, so you should pick the comfort level for yourself knowing the Tech companies can be very volatile. As a general guidelines, risk-averse investors should not own more than 10-15% of Tech instruments, while young people with long time horizon could be fully invested in Tech.

2. SECOND, PICK PROPER TECH INSTRUMENTS: There are many Tech ETFs which you can select from, some of them are Actively managed, most of them are Passively managed, but in the end keep it simple and cover the following “key tech areas”:

4) PORTFOLIO REBALANCE: investors can rebalance portfolio on monthly or quarterly basis or whatever timeframe suites their individual investing style. I personally rebalance on discretional basis when I see that one Tech group has advanced much further than the other one and has reached an important technical resistance level. At that time I use gains from one group and allocate it to the group which is lagging the most in anticipation or “asset rotation” to Tech under-performers which offer better risk reward ratio. I will update my rebalance activity in real time.

3) PORTFOLIO RISK MANAGEMENT

Unlike “Diversified” portfolios with traditional asset classes, such as Stocks, Bonds, Commodities, Real Estate, and Currencies where portfolio volatility is “relatively low” (i.e. it has much lower beta than “all-Tech” portfolio), it’s important to avoid nasty Bear Markets and large drawdowns in tech sectors during those periods.

We will use easy to follow risk management technique anyone can apply in their portfolio risk management. We will use 200 day simple moving average as a “threshold” to determine if an ETF is in bullish or bearish market. If it’s bullish we keep Tech ETF, if it’s bearish we sell that ETF and move money into TBIL ETF (3 month T-bill with goal to preserve capital and provide income). Europeans can shift money into iShare “IB01” 0-1 yr Treasury Bond ETF (this fund is “Accumulating” which reinvests coupons into equity, hence no income tax for investors).

The above Model Portfolio is the approximate simulation of the Model Portfolio described above. There is no enough price data on preferred LRNZ ETF and HODL ETF, so we used ARKK and GBTC (Bitcoin ETN) as a proxy to calculate Portfolio returns since data was publicly available.

There are several takeaways from the above chart:

1) Model portfolio returned 5x the average Market return measured by SPY since 2016 (7 years time span)

2) During this 7 years, ARKK and Bitcoin went through severe correction where they lost 89% and 78% respectively, yet, the Model returned 10x in just 7 years, despite huge drawdowns during 2022 bear market.

3) Notice, how the “protection” kicked in during the 2022 bear market (flat line) when the Model portfolio switched Tech with safe short term Bonds protecting the capital and gaining small income during that time.

4) Maximum drawdown for the Model portfolio was 35% while SPY max drawdown was 34%, hence for the similar “risk taken” the Model portfolio captured 5x higher returns.

This is the whole logic of the Model portfolio. Invest in assets which are able to generate superior returns during strong bull markets, and protect the capital during nasty bear markets when these high beta assets can plunge in some cases over 70, 80 or even 90%

4) SUMMARY

Disruptive Technology companies have tremendous impact on societies around the world, the way we communicate with each other, the way we work or learn new things. Billions of computers, machines, cars, plains, ships, satellites and many other other tools are all powered by chips which are becoming smarter and smarter. Advance Tech companies with superior solutions in Artificial Intelligence, Robotics, Bio-engineering, Crypto and blockchain protocols will disrupt many companies of all sizes which are not ready for the next technology era, and as always new Disruptors with capture lion’s share of customer’s wallet share, while Disrupted companies will fade away and many will cease to exist.

Investors will need to choose carefully how they position their investments. Will they own shares in Disruptors, or in companies that are about to be disrupted will greatly impact the path of wealth creation in the future. We are positioning our investments with fast innovative Technology companies with high growth disrupting products which have potential to disrupt many “traditional” companies around the world and gain outsized returns for their investors.

As investors in Technology companies we should also acknowledge the tech investments are highly volatile, and capital in Tech portfolios should be protected during Bear markets where tech stocks can decline in value in excess of 70, 80 or even 90%.

There are many ways one can manage their investments, and there is no right or wrong way to do it as long as you make money along the way and you do not loose your sleep during market downturns. Our model to achieve both objectives looks like this:

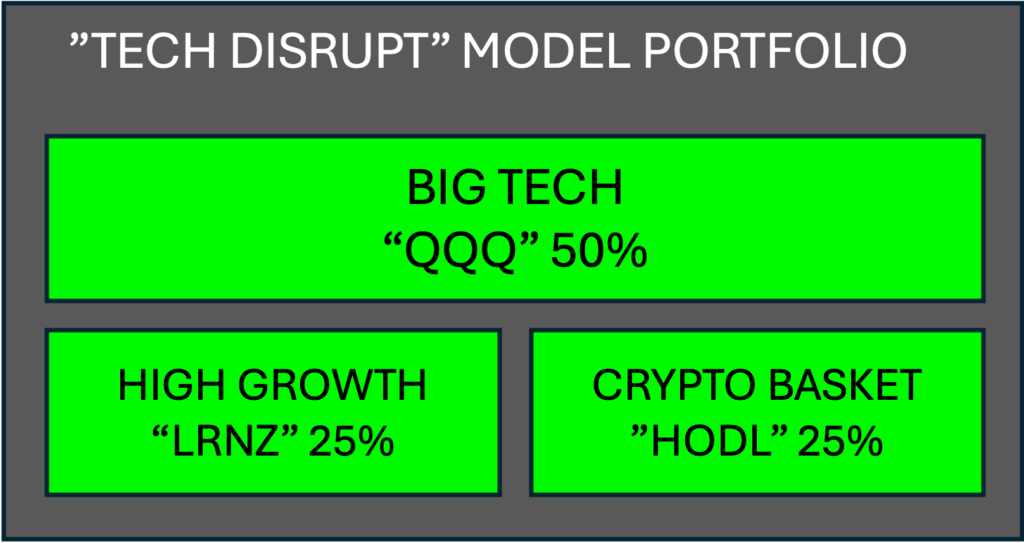

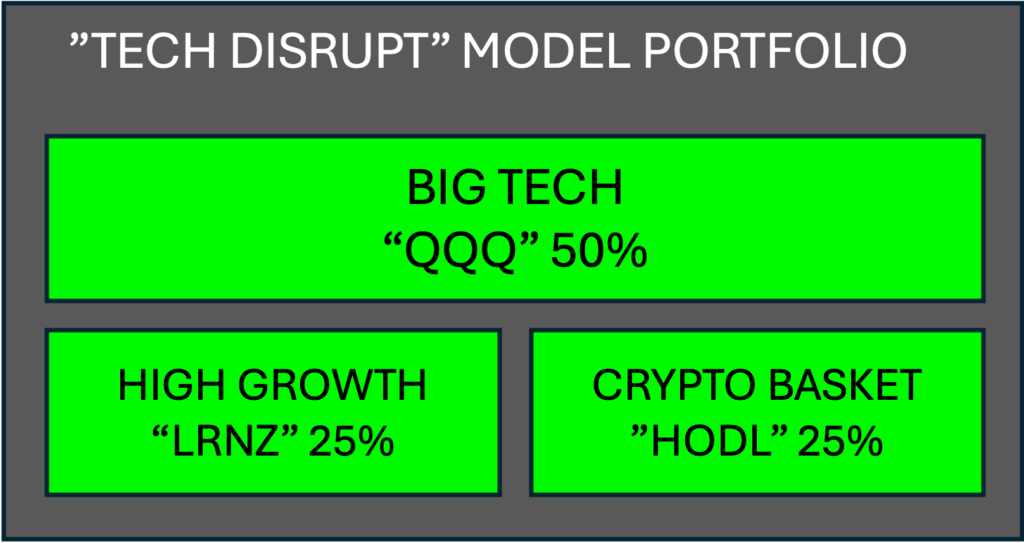

1. Construct simple to manage Tech portfolio which captures 3 main areas:

a) Big Tech (blue chip): “QQQ” top 100 leaders in the Tech segment

b) High Growth Tech (new coming disruptors): “LRNZ”, mostly companies in the mid-cap sectors with great products, high growth revenues and potential to become the next dominant company in their respective technology segment.

c) Cryptos: “HODL”, basket of 5 highest market cap cryptos, which are developing platforms for next generation fintech companies, software, gaming and many more companies which are developing “decentralised” digital products.

2. Manage the risks during vicious Bear markets to sleep better at night:

a) Use simple 200 day moving average to determine if the security is in the Bull or Bear market territory

b) If a security is in Bull market territory, stay fully invested

c) If a security is in Bear market territory, sell the security and shift money into short term Bonds or money market to protect capital and earn yield on your capital.