Intro

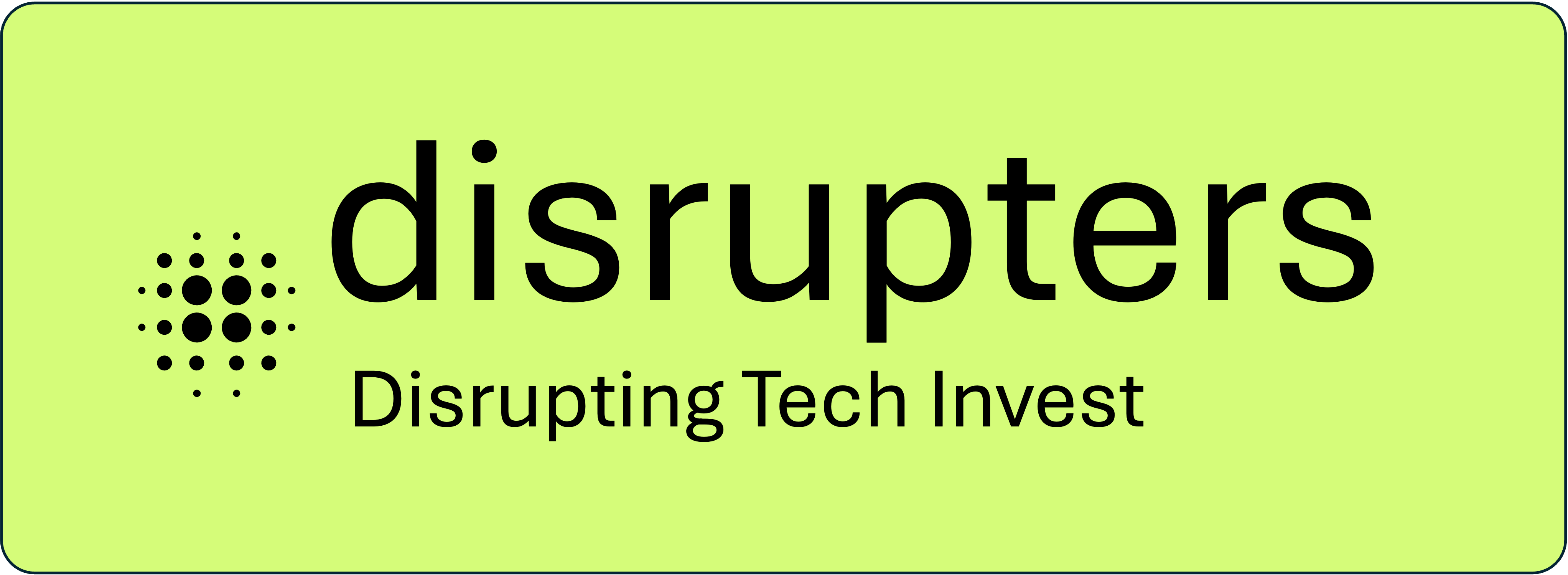

In this section we are stepping back and taking a Big Picture view on Tech sector where we will try to “gauge” (1) what are longer, intermediate and short term trends (2) where in the Cycle is Tech sector now, (3) what are the supportive evidence of our view and (4) what are the risks on horizon and what’s the game plan if they start materialising.

Based on our Big Picture analysis we will (1) aggressively buy “the dips” during the favourable “bullish” conditions, (2) stay neutral during “market neutral” conditions or (3) reduce risks during “unfavourable bearish” conditions.

BIG PICTURE SUMMARY

UPDATED APRIL 15, 2024

We are most likely heading into a short term minor top for equities where we expect 10-15% correction from the recent top, but the overall longer term picture remains BULLISH as of April 2024. Trend following Model is also firmly in the bullish camp.

Short term we see USD and Oil price appreciation as headwinds for other asset classes. We expect both USD and Oil to reach intermediate top within next month or so, at which time investors will have great opportunity to buy good Tech assets on a discount before they resume their new leg higher.

Longer term, key economic indicators and rising corporate profits should be supportive for Equities and Cryptos, and they should provide a floor to risk assets. Hence, as long as we do not see Oil overshoot it’s key resistance area due to geopolitical risks, we believe Tech sector will have legs to advance further into ATH territories.

We acknowledge Tech sector is in mature wave 5 on diverging momentum which can end it’s epic bull run which started in 2009 after GFC at any time, but as always we will not try to pick the top (which can extend for years) and will stay fully invested until our Trend Following Model signals bearish crossover.

1) BIG PICTURE FOR TECH IS BULLISH

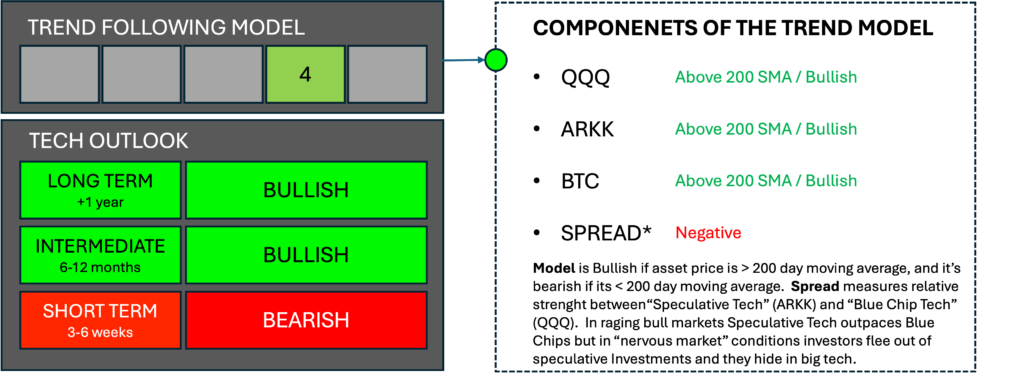

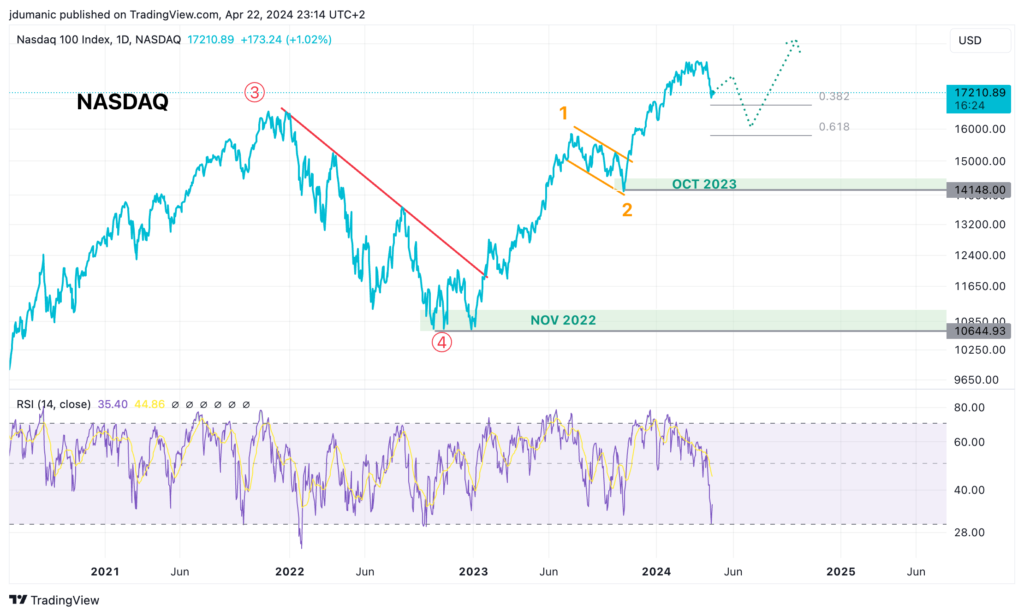

NASDAQ IS IN THE BEGINNING OF WAVE 5, WITH MORE LEGS TO GO UP

NASDAQ just started it’s wave 5 journey, it broke the previous high and is sitting comfortably above it’s 200 day moving average, which are all bullish signs. Normal termination rates for wave 5 are 0.618 and 0.786 Fibonacci extension from the beginning of the trend to wave 3 top which could bring us above 65.000 area (another 280%). However, we acknowledge Wave 5 could also terminate at any moment especially after “prolonged” wave 3 run.

Nonetheless, we believe this wave 5 still has some legs to run further up. Tech is going through an AI euphoria (which is different than dot com bubble in 2000) which could last for a while, valuations are nowhere near 1999 / 2000, Bitcoin is in the “middle” of it’s new cycle up, and Fed is done or almost done with rate hikes.

There will be “bumps” along the way up, but unless the evidence presents itself that we have reached the top we will stay fully invested.

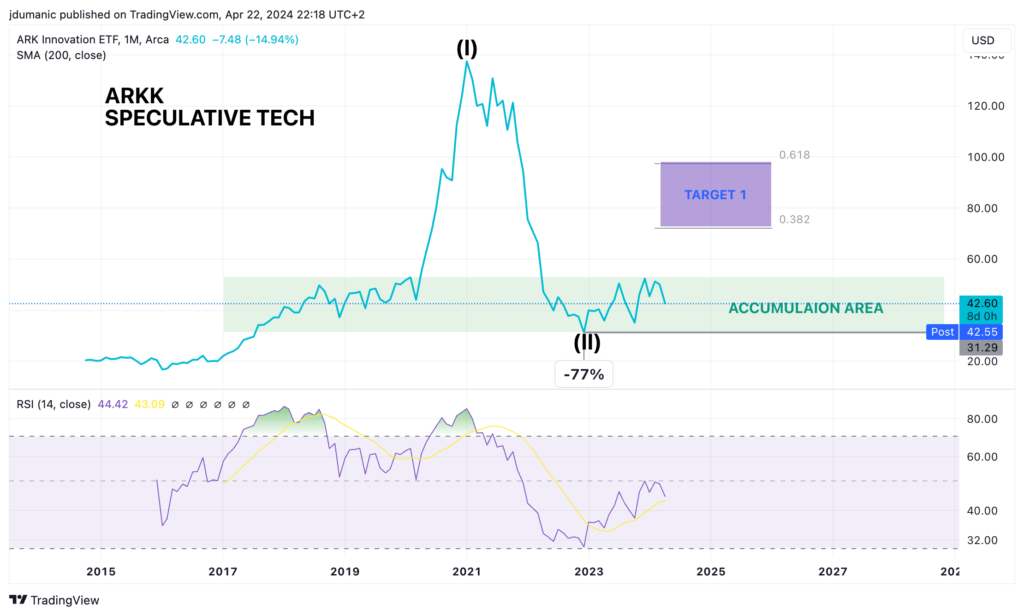

SPECULATIVE TECH (ARKK) IS IN THE ACCUMULATION AREA

Speculative tech has just completed it’s primary wave 2 with the massive drop of 77% in value, similar to Nasdaq drop back in 2001 which presented ones in a lifetime opportunity for investors to capture growth stocks at large discount. Similarly many high growth companies with great products in cybersecurity, fintech, cloud computing, ecommerce and others are beaten down to the historical lows which will present another opportunity to investors to capture extraordinary returns during this decade.

1st target for this group is retrace to 38% and 62% from the major top (+70% -120% return), before resuming higher to ATH area.

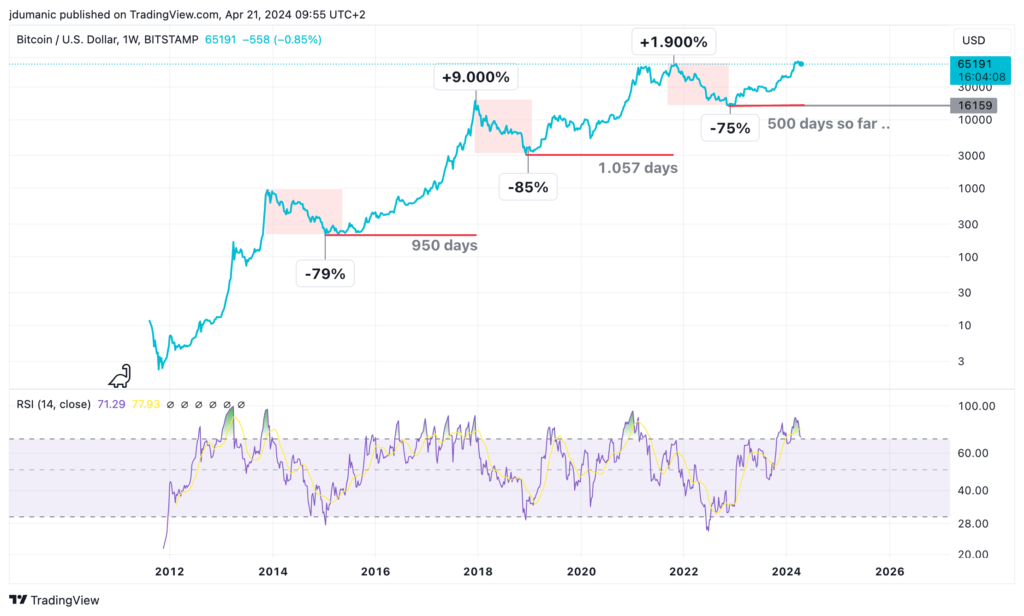

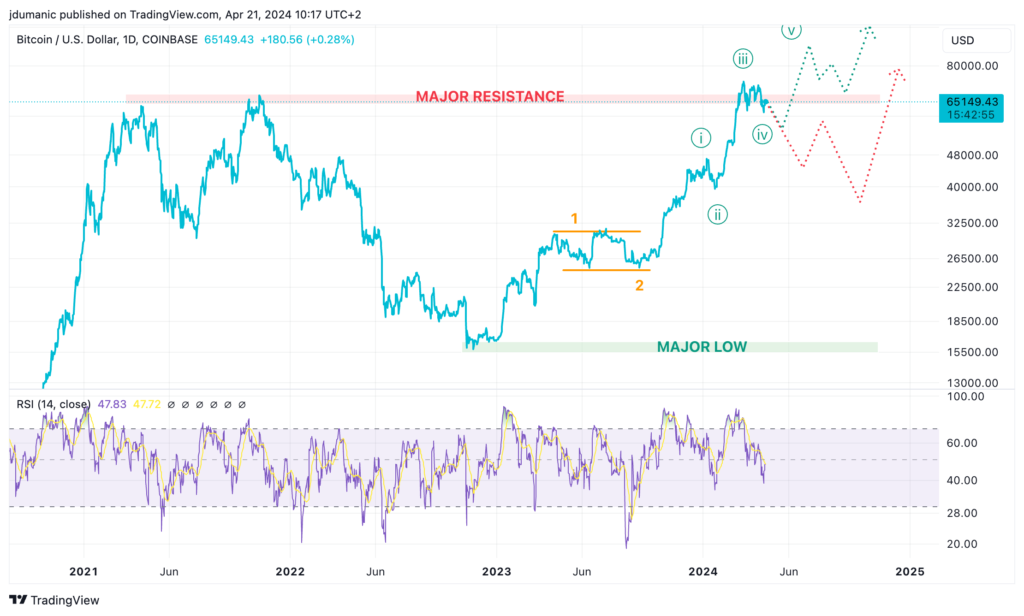

BITCOIN IS AT THE MIDPOINT OF ITS NEW BULL CYCLE UP

Similar to Speculative Tech, Crytos lost massive value (-75%) in the last correction (2022). Previous 2 times when Bitcoin lost so much in value presented tremendous opportunity for investors to capture massive gains +9.000% and +1.900% in just 3 years since the correction ended.

We do not believe gains this time will be as large as last 2 times, but nonetheless gains in Crypto will outpace any other investment class in short amount of time. Previously bull cycles lasted about 3 years, so if history rimes we could expect this bull cycle to run another 1.5 years. However, BTC first needs to clear major resistance built up from 2021 top.

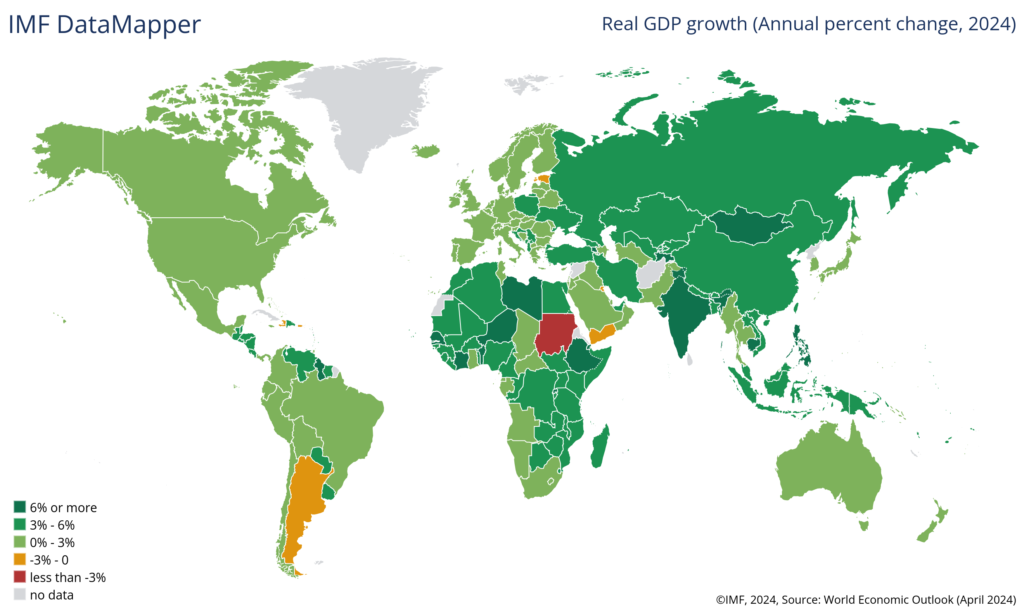

GROWING ECONOMY AND CORPORATE PROFITS SHOULD SUPPORT THIS BULL CYCLE UP FOR A WHILE

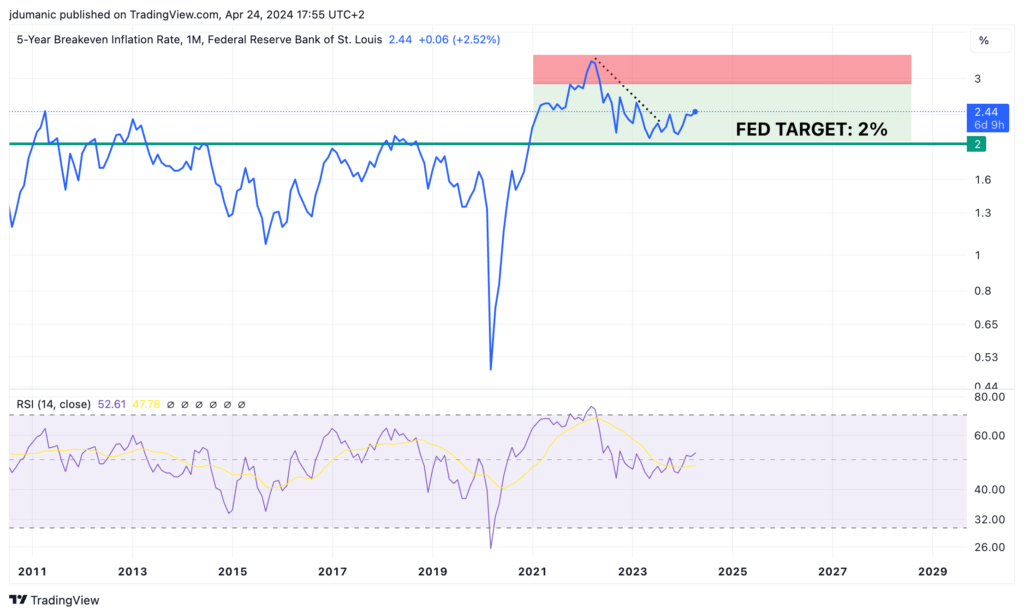

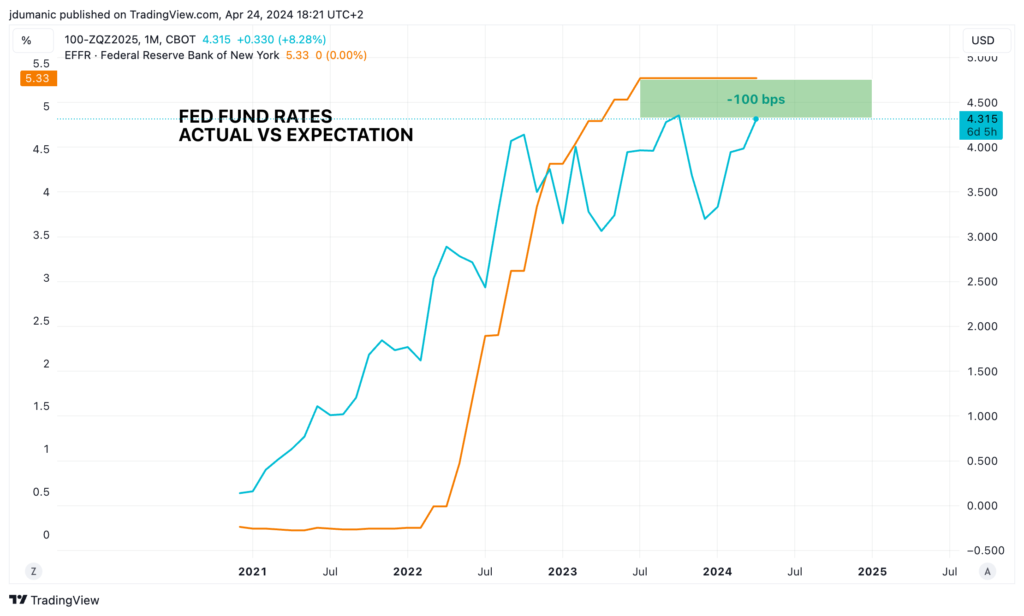

Economies around the world are growing, Inflation is somewhat in check, but it’s far off the peek levels, Jobs are plentiful and Corporate profits are growing which will support both the Stock Valuations and job security. At the same time Central Banks around the world are expected to start lowering rates sometimes late this year or next year which will be another tailwind for the equities and cryptos.

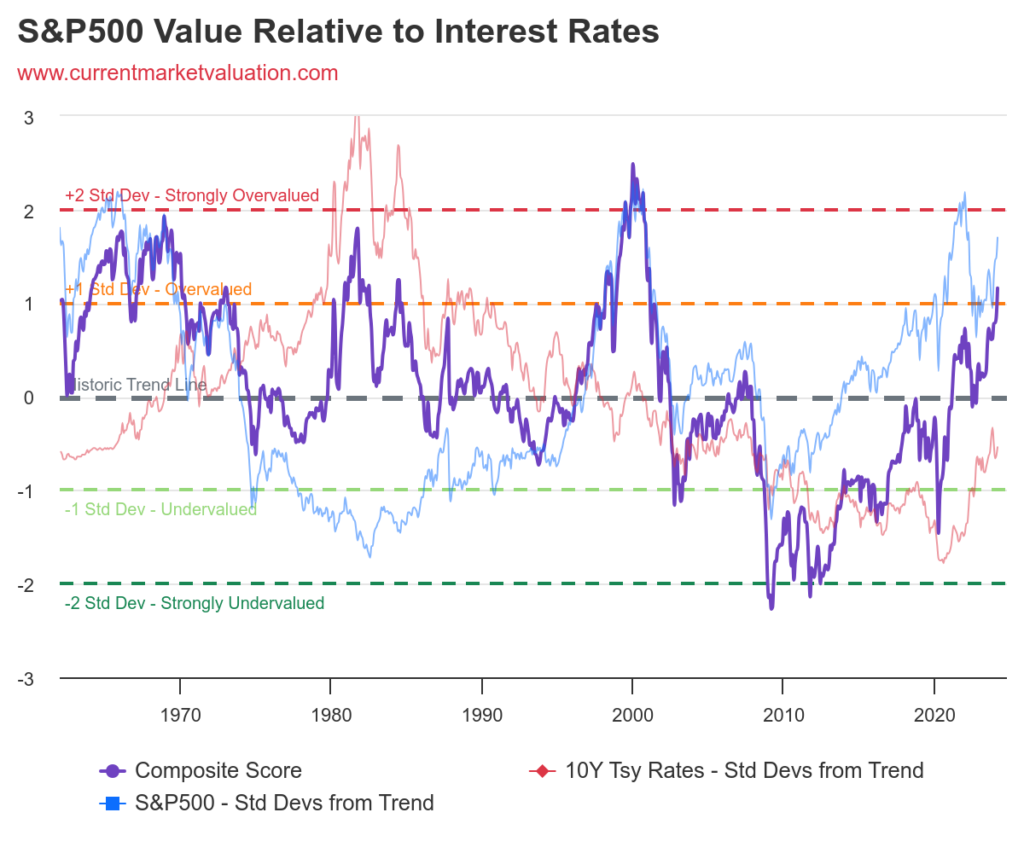

One concern is the Valuation. Using several different metrics, stocks are overvalued by historical standards. The one view that we like the most is “relative valuation” to the interest rates, as interest rates are directly influencing discounted cash flows in the valuation models. Hence, if and when interest rates start dropping, as expected, the valuation metrics will also moderate back toward historical standards and will open up additional celling room for stock multiples to expand.

CONCLUSION ON BIG PICTURE

Main equity indexes started an epic bull run in 2009 after the great financial crises ended, and are now in the terminal wave 5 cycle which could end at any moment. However, we believe this wave 5 has more legs to go (additional 50-100% from here), so we are not planning to sell this bull market any time soon. This believe is supported by 1) growing GDP projections for all regions in the world, 2) moderating inflation expectations, 3) growing corporate profits expectations which will support both stock valuations and job security and 4) easing fed fund rates which will reduce borrowing costs for corporations, improve earnings potential further and will ultimately provide additional tailwind to stock valuations.

Meanwhile, Bitcoin and other cryptos just started another move up, from devastated price drop (-75% and more) back in 2022 and if history rimes, they should be in the mid-cycle to the next market top. Should Bitcoin clear it’s major resistance at $70.000, it should continue advancing towards next resistance level at $100.000, pulling along other cryptos and speculative tech assets.

2) SHORT TERM CYCLE IS IN HEALTHY PULLBACK

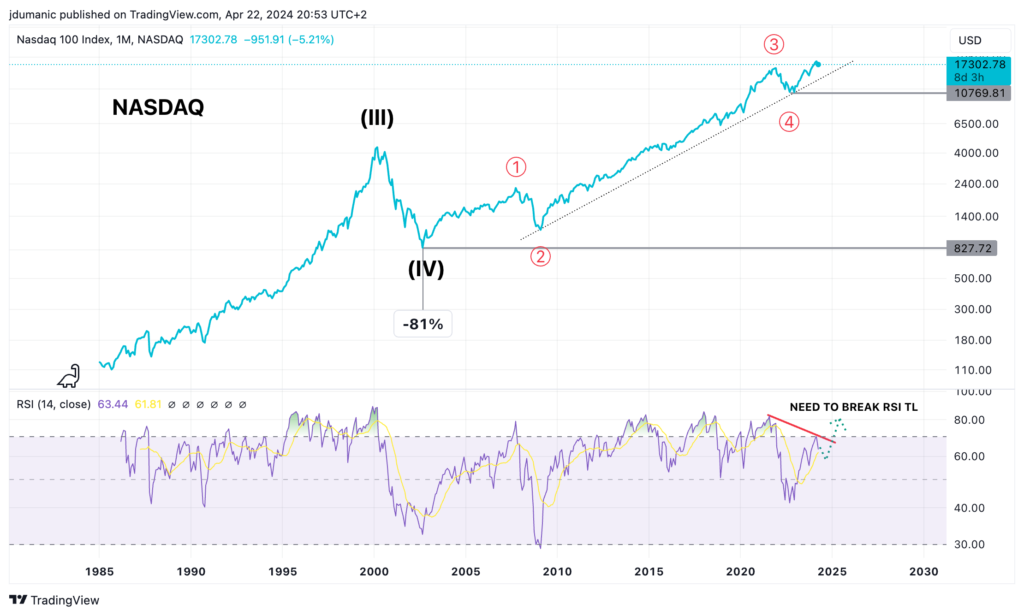

NASDAQ IS (MOST LIKELY) CORRECTING OCTOBER 2023, NOT ENTIRE CYCLE FROM NOVEMBER 2022

We believe Nasdaq is correcting October 2023 with the retracement target of 15.790 and 16.790 which is about 8%-15% drop from the recent top. Currently we’re in the A leg of the full retracement, hence soon we can expect the rebound in wave B than final flush toward the target retracement zone. Once we have completed A&B legs, we’ll get a better idea where C leg might land.

There is always a risk we might be correcting the full cycle since November 2022 low, which would be driven by Oil and USD extending higher. If Oil extends higher (beyond the next resistance area), this will increase market expectation of resumed inflationary pressures which will push yields higher and long duration Tech assets lower.

SPECULATIVE TECH IS STILL FAR BEHIND THE BIG TECH, BITCOIN IS SOMEWHERE IN BETWEEN

Speculative Tech (high growth companies but mostly still non GAAP profitable) are still sitting in the Accumulation zone after gigantic valuation reset of -70% and more. They are still finding it’s structure and Elliot Wave definition which could morph into many different patterns. If the Big Tech resume it’s path upwards (as we expect it), than Speculative Tech will play a catch-up and will break out of the Accumulation zone, hence we’re counting Jul-Oct correction as wave 1-2, and we’re expecting ARKK to start soon it’s wave 3 up.

Bitcoin is somewhere between Speculative Tach and Big Tech. It’s definitely outside of it’s accumulation zone already, and after the completion of 1-2 wave, Bitcoin started explosive wave 3 advance (we expect similar will happen with Speculative Tech soon). Now it’s sitting right at the major resistance level where it was stopped 2 times already in the past. Bitcoin must clear this heavy resistance soon to catch up with Big Tech and to resume it’s wave 3 advance, otherwise this cold become triple top which is an intermediary bearish formation.

We see 2 paths going forward. (1) If Oil reverses soon, Bitcoin will have a shallow pullback bellow the resistance line and will break the line soon and resume towards 100k, and (2) if Oil pushes higher (beyond the next resistance area – see “Risk on horizons” below) than Equities and Cryptos will go through “double – dip” correction (2x ABCs), and will correct entire cycle from November 2022, before advancing higher.

3) RISKS ON HORIZON

KEY RISKS FOR EQUITIES AND CRYPTOS IS THE OIL / USD / BONDS COMBO

Oil is “THE” Commodity now everyone is looking at for clues which way inflation will go. If oil keeps climbing up and breaks above 2022 high, if oil enters the “super-cycle” phase to ATH, we can scratch the bullish outlook for stocks and cryptos. USD will also shoot up in anticipation of higher interest rates, Bonds will sell of in anticipation of higher inflation and will push yields up, and the combination of strong USD (deflationary force) and high interest rates is lethal cocktail for risk assets.

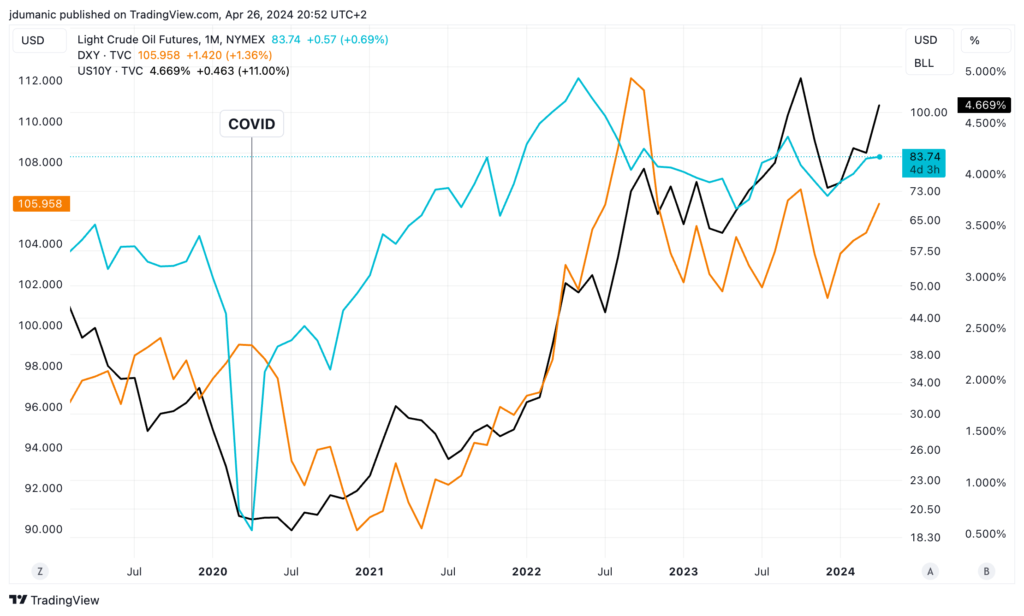

Look what happened since Covid low. First, the Oil started the move up, Bond yields followed almost immediately after, about year later USD started the “catch-up game” and it exploded higher. During 2022 USD and OIL started pulling back, Bonds followed year later as they were spooked by the FED’s aggressive tightening cycle.

We should monitor the development of all 3 mayor asset classes, but for us OIL is in the driving seat for now.

Wherever Oil goes from here, the other two will follow (in our opinion). So, let’s take a look at the Oil chart and let’s see where it might go next.

OIL = NEUTRAL (FOR NOW) .. but,

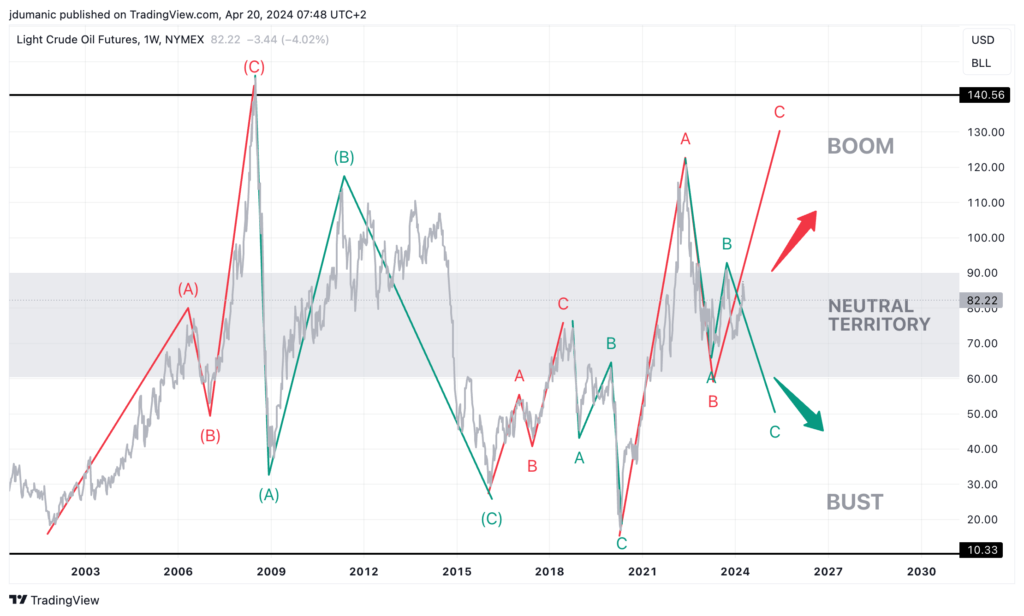

Let’s first take a long term view to see where Oil is currently trading. If we observe Oil price for last 20 years we can see the price is traded in the “neutral territory“.

Second observation is that Oil price is not staying in the “neutral territory for a long time. It usually follows Boom & Bust pattern, and it’s typically running from one extreme to another extreme.

When economies around the world “overheat” / and / or there is a shortage of supply, Oil price tent to explode upwards. Such episodes are followed by increased inflation which is then followed by Fed tightening cycle to fight inflation which often causes recession at which time Oil prices collapses.

Third observation (bottom chart) is that Oil price is moving up or down in 3 waves (ABC). So what’s next for Oil, up or down. The chart is “incomplete” and we could see couple different paths from here.

a) Direct moon shot up to RED C

b) Complete intermediate C leg (green) down first before starting larger C (red) leg up.

The direction will depend on many factors such as geopolitical situation with Israel / Iran, inventory levels, OPEC decision on output quotas and many other factors which are above our pay-grade, so we will not try to predict which way the breakout will take place, but we know we will adjust our portfolio once we see the breakout on either side.

WHAT ARE WE WATCHING?

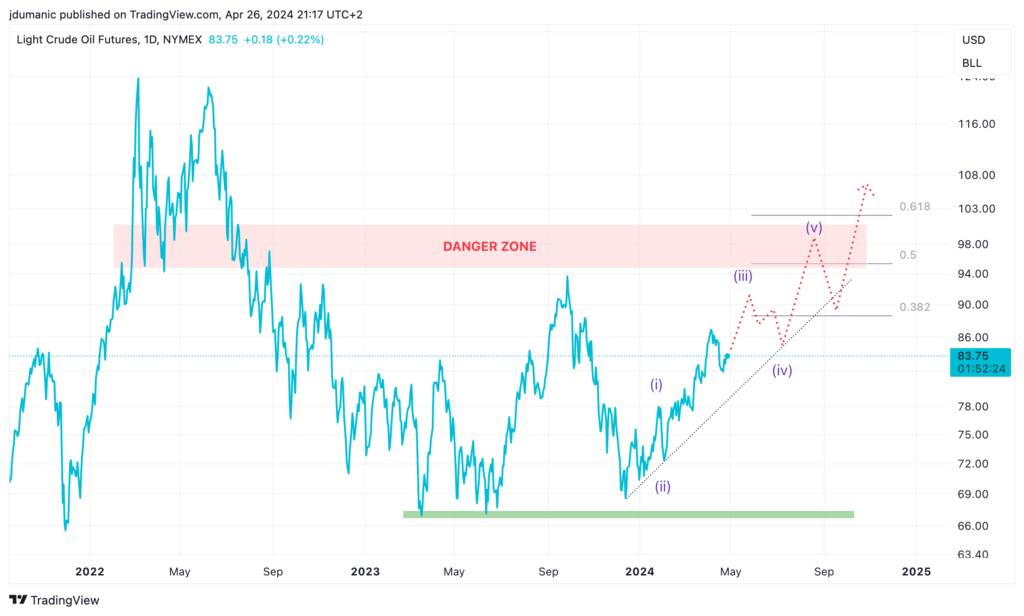

1) First warning sign will be to see 5 waves up from the December 2023 low

2) Second warning will be 3 wave (not 5) pullback from the next top

3) Final warning will be the breakout above the “Danger Zone” above $100

If that happens, Oil is than most likely in larger degree wave 3 which can go way further than 2022 top. If that happens, Bonds and USD will follow the path and that will be the toxic combination for equities (especially technology and cryptos). Under such scenario, we believe both SPX and Nasdaq will trade below its 200 day moving average and we’ll be sitting on the sidelines with our Tech portfolio.

4) CONCLUSION

Nasdaq is in long term bull market, in the final terminal wave 5 which might be terminated at any time. However we belive this bull still have legs to go higher (60-100% from here) based on improved economic growth around the world, improving corporate earnings which will provide support for stock valuations and job security, and Fed’s lowering rates sometimes next year which will be another tailwind for Tech stocks.

We are currently going through a healthy pullback which should be relatively shallow (8-14%) and we are already half way through that drawdown. Once Nasdaq is done with the correction we can use it as timing instrument to jump back into our favourable stocks or cryptos which will start a new leg higher. In this next cycle up, we expect Nasdaq to go to new ATH, Cryptos to break magical resistance layer and resume to $100k mark, while Speculative Tech will play a catch up game and will break away the base (accumulation zone) and will run towards previous 2021 top.

Risk on the horizon is the price of Oil, which has “technical” capabilities to push north of $100 which would trigger USD and Bond Yields to go higher as well, and that would trigger the sell off in equities and cryptos and possibly end this bull cycle which started back in 2009.

If this scenario happens, major indices will drop below 200 day moving average and we’ll exit the market and wait for more favourable moment to jump back in.